These 3 Money Habits Will Make Saving Up For Your Holidays Easy

And as a result, will make frequent traveling more attainable.

Want to travel often, but your bank account disagrees?

We know the struggle 🥲

After 54 trips in 7 years, we've figured out how to always keep our travel fund ready for our next adventure. And in this blog, we’re sharing our 3 essential money habits with you. These habits ensure stress-free travel planning, giving you the freedom to choose your next destination without any financial dread.

Say goodbye to wishful thinking and hello to making your travel goals a reality!

Analyse your past spending

The best place to start planning for your next trip is by reviewing your bank statement.

Oh no, let’s not go there…

Okay, but how will you know the budget for your next holiday if you don’t know how much you spent during the last one?

It’s time to face the numbers.

Review all of your card transactions and note down of any travel-related expenses. Keep track of the expenses for each trip, ranging from an ice cream cone in France to a tuk-tuk ride in Thailand. And don’t forget to scroll back a bit further to when you booked your flights and accommodation!

💡 For even more accuracy and ease you can download your bank transactions as a csv file and work in an Excel or Google Sheets doc.

You should end up with an overview of all the costs for each holiday and the costs per year. Now that you’ve done this once, do this on a frequent basis.

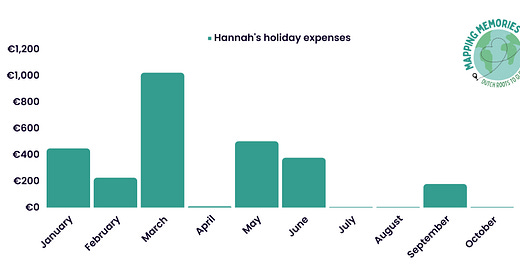

For example, Hannah categorizes all her expenses and transactions at the end of each month. Because of this, she knows she’s spent €2,782.05 on travel in 2023, which is €278.20 on average per month.

Once you know how much money you need for your holidays, this next habit will ensure you’ve always got enough saved up.

Automatically save a fixed amount each month

By doing this, you won’t have to worry about manually saving up for your holidays.

Without fail, the budget steadily grow without having to think about it at all. You can simply check how much you’ve saved up when the planning phase starts.

How does one go about this?

By setting up a monthly automatic transfer right after payday.

Let’s use Hannah’s example again.

At the start of the year, she had an automatic transfer of €200 from her checking account to her holiday savings. When she started her full-time job, she increased the amount to €450.

The day after her salary comes in, €450 automatically gets put aside for upcoming travels. No questions asked.

Also note how this amount is more than her average travel expenses per month. This way she’s sure that it will cover her yearly holiday spending.

By implementing this habit, you’re not saving for one specific trip, but for all future holidays - both the planned and spontaneous ones.

And if you want to save up more than a fixed amount each month or your wiggle room for additional saving is limited, try to put all the extras into the holiday jar.

Extra income = extra holiday savings

Do you sometimes receive extra cash that doesn’t have a specific purpose straight away?

Perhaps you’ve received money from a grandparent, gotten a bonus at work, or maybe you’ve earned additional money through a side hustle.

Make it a habit to put some (or all) of this extra income into your holiday savings.

In Mike’s case, he works standy shifts and regularly receives extra income on top of his salary. Where does it go? The holiday budget.

Hannah does freelance work next to her full-time job and doesn’t need it to cover any expenses. Where does it go? The travel fund.

When additional money gets added to your main account, you will most likely spend it on something random. A new sweater, a decorative item for your house, or an extra coffee on the weekends.

By putting it aside, you make sure it gets spent mindfully.

Consider it a delayed gift to yourself - a gift in the form of unforgettable travel experiences.

And yes, for the gift of this habit, you may thank us later 😉

Boost your savings

We hope these 3 easy money habits inspire you to start or refine your travel-saving strategies.

Which of them will you try to implement before the start of 2024? Let us know in the comments!

And if you have any useful saving methods yourself that we can learn from, we’d love to hear them. We’re always on the lookout for additional ways to increase our holiday budget 👀

Thanks for reading this post, good luck with saving up, and until next Saturday 🙋